- Home

- »

- Organic Chemicals

- »

-

Corrosion Inhibitors Market Size, Share, Industry Report 2030GVR Report cover

![Corrosion Inhibitors Market Size, Share & Trends Report]()

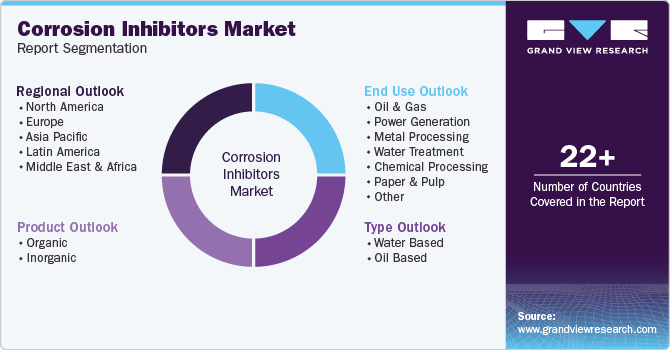

Corrosion Inhibitors Market Size, Share & Trends Analysis Report By Product (Organic, Inorganic), By Type (Water Based, Oil Based), By End Use (Oil And Gas, Chemical Processing), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: 978-1-68038-210-5

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

Corrosion Inhibitors Market Size & Trends

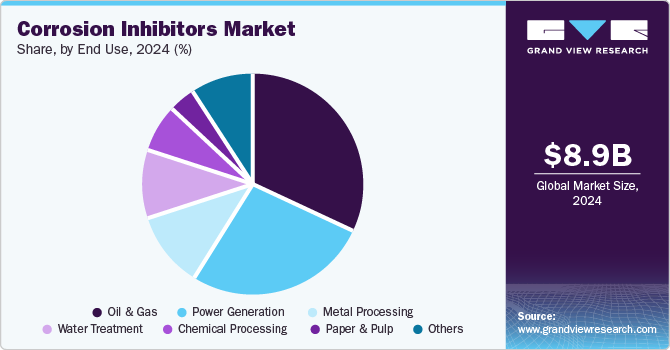

The global corrosion inhibitors market size was valued at USD 8.93 billion in 2024 and is expected to grow at a CAGR of 3.6% from 2025 to 2030. This growth is attributed to the increasing demand from the oil and gas, automotive, and construction industries significantly contributes to this trend. In addition, rising disposable incomes and the need for treated water in various sectors further propel market expansion. Furthermore, emerging economies are witnessing rapid industrialization, leading to heightened requirements for effective corrosion protection. Moreover, environmental concerns also drive the shift towards eco-friendly corrosion inhibitors, enhancing their acceptance across diverse applications globally.

Corrosion inhibitors are essential chemical agents used to mitigate the deterioration of materials, particularly metals, caused by chemical or electrochemical reactions to their environment. These substances are vital in various industries, including oil and gas, construction, water treatment, and automotive manufacturing, as they help maintain the integrity and longevity of metals and alloys. Corrosion inhibitors function by forming a protective barrier on metal surfaces or modifying environmental conditions to decrease reactivity.

There are several types of corrosion inhibitors. Anodic inhibitors create a protective film on metal surfaces, effectively preventing oxidation and corrosion initiation. Cathodic inhibitors, such as zinc and magnesium compounds, slow down reduction reactions at the metal surface. In addition, mixed inhibitors comprise both anodic and cathodic properties for comprehensive protection against corrosion. Vapor phase inhibitors (VPIs) release volatile substances that form a protective layer in enclosed spaces, making them effective for hard-to-reach areas.

The economic implications of corrosion are significant; industries increasingly recognize that using corrosion inhibitors can lead to substantial cost savings. Stricter environmental regulations also push for adopting eco-friendly corrosion inhibitors, reflecting a shift towards sustainable practices. Moreover, advancements in nanotechnology have led to the development of more efficient nano-based corrosion inhibitors. However, challenges remain, including high initial costs for new technologies and limited awareness in developing markets about the benefits of these protective agents. Emerging technologies continue evolving, presenting opportunities and competition for traditional corrosion inhibition methods.

Product Insights

The organic corrosion inhibitors dominated the market and accounted for the largest revenue share of 75.6% in 2024, primarily driven by the increasing demand for environmentally friendly solutions across various industries. As regulations tighten, particularly in regions such as Europe and North America, companies seek organic inhibitors derived from natural sources that minimize environmental impact while maintaining effectiveness. Furthermore, the oil and gas sector and construction and water treatment industries contribute to this growth, as organic inhibitors are favored for their ability to form protective layers on metal surfaces and lower toxicity compared to inorganic options.

The inorganic corrosion inhibitors segment is expected to grow at a CAGR of 3.2% over the forecast period, driven by their effectiveness in harsh conditions, such as high temperatures and pressures. These inhibitors, including chromates, phosphates, and nitrates, are widely used in critical infrastructure development and power generation applications. In addition, the ongoing growth in infrastructure projects, particularly in emerging economies, boosts demand for these robust solutions. Furthermore, advancements in secondary zinc-based and silicate-based inhibitors enhance the performance of inorganic options, making them more appealing for industries requiring reliable corrosion protection under challenging operational environments.

Type Insights

The oil-based corrosion inhibitors held the dominant position in the market and accounted for the largest revenue share of 55.6% in 2024. This growth is attributed to the increasing oil and gas industry demand. In addition, these inhibitors provide superior protection for metal surfaces exposed to harsh conditions, such as high temperatures and corrosive chemicals, making them essential for exploration, extraction, and transportation equipment. The stability of crude oil prices also plays a crucial role in driving investments in this sector. Furthermore, the need for effective corrosion control solutions to minimize downtime and maintenance costs further propels the demand for oil-based inhibitors.

The water-based corrosion inhibitors are expected to grow at a CAGR of.3.7% from 2025 to 2030, owing to a growing emphasis on environmentally friendly solutions. These inhibitors are favored for their ease of application and effectiveness in protecting equipment in aqueous environments, such as cooling systems and pipelines. In addition, stricter environmental regulations push industries toward safer, non-toxic alternatives, enhancing the appeal of water-based formulations. Furthermore, the rising demand for treated water across various sectors, including manufacturing and water treatment, is contributing to the increased adoption of water-based corrosion inhibitors as industries seek to ensure the longevity and reliability of their assets.

End Use Insights

The oil and gas sector led the market and accounted for the largest revenue share of 32.2% in 2024, driven by the increasing exploration and production activities. As global energy demands rise, effective corrosion protection solutions become critical to safeguard infrastructure and equipment from corrosive environments. In addition, aging pipelines and facilities and stringent safety regulations further amplify the demand for robust corrosion inhibitors. Furthermore, the high costs associated with corrosion-related failures motivate companies to invest in effective prevention strategies, ensuring operational efficiency and safety.

The water treatment segment is expected to grow at a CAGR of 4.3% over the forecast period, owing to the rising demand for treated water across various industries. As freshwater resources become increasingly scarce, efficient water recycling and treatment processes are essential. In addition, corrosion inhibitors play a crucial role in protecting metal machinery from deterioration caused by water flow. Furthermore, as the largest consumer of these inhibitors, the industrial sector seeks effective solutions to minimize equipment downtime and maintenance costs. Moreover, stricter environmental regulations are driving the adoption of eco-friendly corrosion inhibitors, enhancing their appeal in water treatment applications.

Regional Insights

The North America corrosion inhibitors market is expected to grow at a CAGR of 3.6% over the forecast period, owing to the growing oil and gas industry requiring effective solutions to protect pipelines and equipment from corrosion. In addition, the region's strong manufacturing base, particularly in the automotive and aerospace sectors, also contributes significantly to this growth as companies seek to enhance the durability of their products. Furthermore, ongoing infrastructure projects and stringent environmental regulations push industries towards advanced corrosion protection technologies to ensure compliance while minimizing maintenance costs.

The corrosion inhibitors market in the U.S. dominated the North American market and accounted for the largest revenue share in 2024, driven by high production rates in the automotive and aerospace industries. Furthermore, government investments in renewable energy projects require specialized corrosion inhibitors to protect critical components. This focus on enhancing energy efficiency and safety standards supports the overall growth of the corrosion inhibitors market in the country.

Asia-Pacific Corrosion Inhibitors Market Trends

Asia-Pacific corrosion inhibitors market dominated the global market and accounted for the largest revenue share of 37.2% in 2024 attributed to the increasing industrialization and urbanization in countries such as China and India. In addition, the rising demand for effective corrosion protection solutions is fueled by significant investments in infrastructure development across various sectors, including construction and manufacturing. Furthermore, this region's growing oil and gas industry necessitates advanced corrosion control measures to protect equipment from harsh operational environments.

The corrosion inhibitors market in China dominated the Asia-Pacific market and accounted for the largest revenue share in 2024, driven by its rapid economic growth and status as a leading energy consumer. In addition, the country's extensive industrial activities drive demand for corrosion inhibitors as industries seek to safeguard their infrastructure from deterioration. Moreover, China's focus on low-carbon initiatives and renewable energy projects further influences the need for effective corrosion protection solutions across various applications, positioning it as a critical market for growth in this sector.

Europe Corrosion Inhibitors Market Trends

Europe corrosion inhibitors market is expected to grow significantly, driven by strict environmental regulations that encourage the adoption of eco-friendly solutions. Furthermore, the region's strong industrial base drives demand for effective corrosion protection, especially in the automotive, manufacturing, and chemical processing sectors. Moreover, ongoing investments in infrastructure development and water treatment facilities further bolster market growth as industries seek reliable methods to mitigate corrosion risks while adhering to sustainability goals.

The growth of the corrosion inhibitors market in Germany is primarily driven by its advanced manufacturing capabilities and commitment to sustainability. In addition, the automotive sector is a major contributor to market growth as manufacturers seek innovative solutions for corrosion protection. Furthermore, Germany's focus on renewable energy initiatives is fueling demand for specialized inhibitors across various applications, ensuring that critical components remain protected against corrosion while supporting environmental objectives.

Key Corrosion Inhibitors Company Insights

Some of the key players in the global corrosion inhibitors industry include Nouryon, Cortec Corporation, Ashland, and others. These companies are adopting various strategies to enhance their competitive edge. These strategies include new product formulations, focusing on eco-friendly solutions to meet regulatory requirements, and expanding their product portfolios to cater to diverse industries. Furthermore, companies are forming strategic partnerships and collaborations to leverage technological advancements and enhance distribution networks, ensuring broader market reach and customer engagement while effectively addressing specific industry needs.

-

Ashland manufactures a range of products designed to protect metals from corrosion, particularly through its Ashland Water Technologies division. This segment provides process and utility chemistries that enhance operational efficiencies and protect plant assets across sectors such as food and beverage, pulp and paper, and industrial applications. The company’s corrosion inhibitors are essential for maintaining equipment integrity and ensuring compliance with environmental regulations.

-

Ecolab manufactures various chemical solutions to prevent corrosion in critical applications across various industries, such as oil and gas, food processing, and manufacturing. The company operates in the water treatment segment, offering innovative products that help manage water quality and protect infrastructure from corrosive damage. Their corrosion inhibitors are designed to enhance equipment lifespan and operational efficiency while addressing environmental sustainability concerns in industrial processes.

Key Corrosion Inhibitors Companies:

The following are the leading companies in the corrosion inhibitors market. These companies collectively hold the largest market share and dictate industry trends.

- Nouryon

- Cortec Corporation

- Ashland

- Ecolab

- Henkel Ibérica, S.A.

- The Lubrizol Company

- BASF SE

- Dow

- DuPont de Nemours, Inc.

- Baker Hughes, a GE company LLC

Recent Developments

-

In August 2024, PPG unveiled its latest innovation, PPG PRIMERON Optimal, a powder primer featuring optimized zinc for enhanced corrosion protection. This advanced primer is designed to improve adhesion and durability, making it ideal for various industrial applications. By incorporating effective corrosion inhibitors, PPG PRIMERON Optimal significantly extends the lifespan of coated surfaces, ensuring superior performance in challenging environments. This launch reflects PPG's commitment to providing high-quality solutions that meet customers' evolving needs in protective coatings.

-

In March 2023, Cortec announced a significant advancement in corrosion inhibitors by introducing VpCI-649 HP, certified to meet ANSI/NSF Standard 61 for hydro-testing drinking water systems. This innovative product offers effective corrosion protection during hydrostatic testing, which is crucial for ensuring the integrity of vessels and piping. With a low dosage requirement and minimal chloride impact, VpCI-649 HP not only safeguards metal surfaces but also expands opportunities for safe use in drinking water applications, enhancing industry standards for corrosion prevention.

Corrosion Inhibitors Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 9.26 billion

Revenue forecast in 2030

USD 11.06 billion

Growth Rate

CAGR of 3.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in Tons, Revenue in USD Million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, Type, end use, region.

Regional scope

North America, Asia Pacific, Europe, Latin America, Middle East and Africa.

Country scope

U.S., Canada, Mexico, China, India, Japan, South Korea, Germany, UK, France, Italy, Brazil, Argentina, UAE, Saudi Arabia, and South Africa.

Key companies profiled

Nouryon; Cortec Corporation; Ashland; Ecolab; Henkel Ibérica, S.A.; The Lubrizol Company; BASF SE; Dow; DuPont de Nemours, Inc.; Baker Hughes, a GE company LLC.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Corrosion Inhibitors Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global corrosion inhibitors market report based on product, type, end use, and region.

-

Product Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Organic

-

Inorganic

-

-

Type Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Water Based

-

Oil Based

-

-

End Use Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Oil and Gas

-

Power Generation

-

Metal Processing

-

Water Treatment

-

Chemical Processing

-

Paper and Pulp

-

Other

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

UAE

-

Iran

-

Iraq

-

Saudi Arabia

-

Kuwait

-

Oman

-

Bahrain

-

South Africa

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."